Excise, VAT, CST, and service taxes all required their own sets of accounts to be kept up to date. Additionally, the input tax credit could not be used to offset State and Central taxes. As a result, numerous ledger accounts were required. However, GST was able to eliminate the requirement for numerous ledger accounts, limiting it to a few.

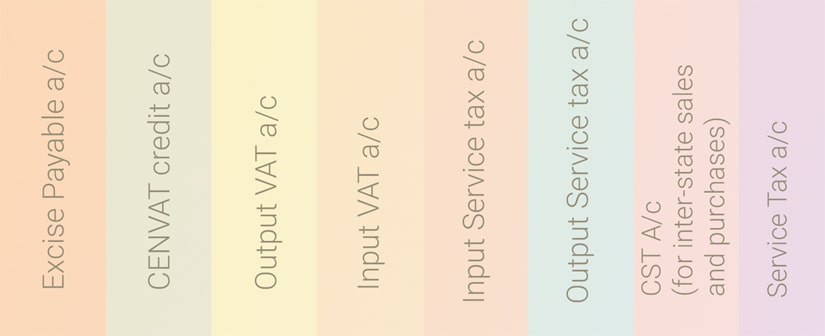

The few ledgers account that businesses were required to keep under the previous administration are listed below (aside from accounts for purchases, sales, and stock):

- Excise Payable a/c (manufacturers)

- CENVAT credit a/c (manufacturers)

- Output VAT a/c

- Input VAT a/c

- Input Service tax a/c

- Output Service tax a/c

For instance, trader Mr. X was required to maintain the following minimum basic ledger accounts:

- Output VAT a/c

- Input VAT a/c

- CST A/c (for inter-state sales and purchases)

- Service Tax a/c (Since he is a trader with output VAT, he cannot claim any service tax input credits. Service tax cannot be deducted from VAT or CST)