Filing a return under the GST is mandatory even if there is no transaction. In such cases, the taxpayer needs to file a Nil return.

Key Points to Note:

- One cannot file a return for a month if the taxpayer did not file for the previous month/quarter.

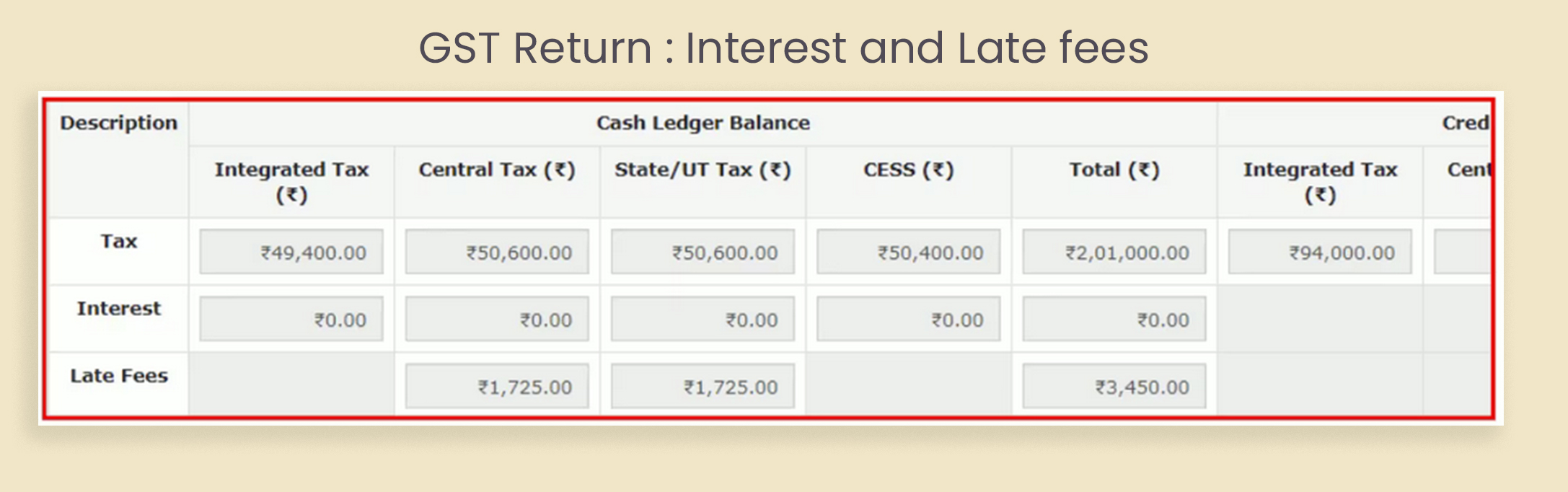

- So, late filings will have a falling effect on the taxpayer due to imposing heavy fines and penalties.

- The penalties and fines of the GSTR-1 are shown on the liability ledger of GSTR-3B which needs to be filed immediately after delay.