Comprehensive GST Compliance for Streamlined Accounting

WrkPlan’s advanced GST management tools ensure seamless compliance with evolving regulations. From e-invoicing to return filing, our platform offers robust, cloud-based solutions that safeguard your tax data and enhance your financial operations.

-

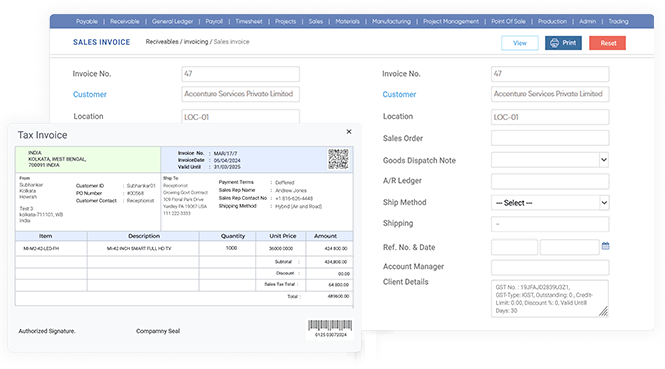

E-Invoicing Made Effortless

WrkPlan simplifies the e-invoicing process by providing a robust and customizable toolkit that seamlessly integrates with the Invoice Registration Portal (IRP). Generate, validate, and manage e-invoices efficiently while ensuring full compliance with GST mandates.

- Instant E-Invoice Generation

- Customizable Invoice Templates

- Automated Data Population

- Bulk Processing Capability

- Seamless ERP Integration

- Audit Trail and History

-

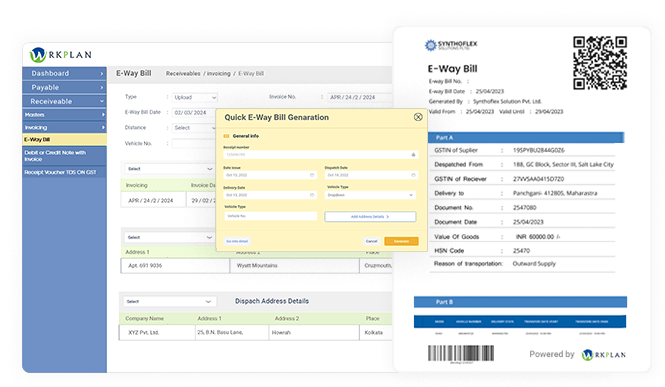

Simplified E-Way Bill Management

Optimize your logistics and supply chain operations with WrkPlan’s integrated e-way bill solution. Effortlessly generate, manage, and track e-way bills to ensure smooth and compliant movement of goods across states.

- Quick E-Way Bill Generation

- Customizable Templates

- Auto-Detection of Transactions

- Real-time Tracking

- Consolidated E-Way Bills

- Expiry Alerts and Notifications

- Integration with GST Portal

-

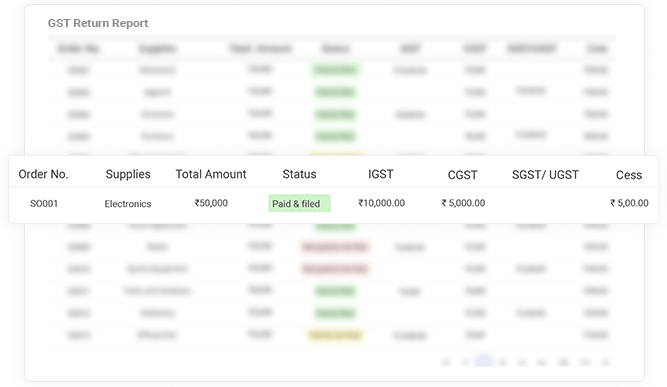

Efficient GST Return Filing and Reporting

WrkPlan empowers your finance team with streamlined tools for accurate and timely GST return filings. Manage all aspects of GST returns, including data preparation, validation, and submission, while maintaining organized records for audit and analysis.

- Comprehensive Return Filing

- Automated Data Compilation

- Error Detection and Validation

- Historical Data Management

- Dynamic Reporting and Analytics

- Due Date Reminders and Alerts

- Reconciliation Tools

-

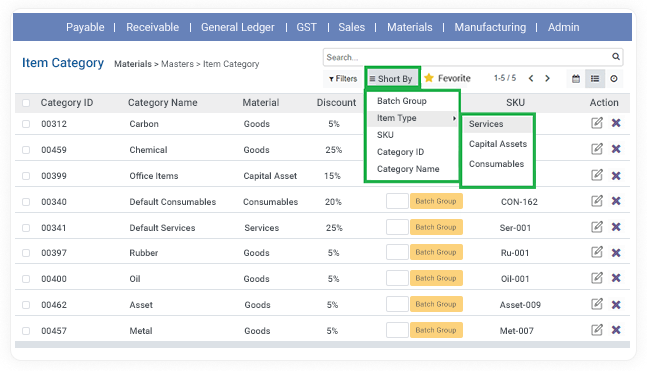

Precise Item Categorization for Accurate Taxation

Achieve meticulous tax management by categorizing your products and services accurately within WrkPlan. Proper classification ensures correct tax application and facilitates seamless compliance across all transactions.

- Detailed Item Classification

- Intelligent Search Functionality

- Automated Tax Rate Application

- Bulk Update Capabilities

- Compliance Verification

- Custom Attributes and Tags

- Integration with Inventory Management

Additional Features

Multi-Branch Accounting

With our accounting solution, you can easily streamline your financial transactions across...Budgeting and Forecasting

Revolutionize the way you approach your finances with WrkPlan's Budgeting and Forecasting...Accounts Payable and Receivable

Optimize your accounts payable and receivable workflows with WrkPlan. You can easily...Bank Reconciliation

Simplify bank reconciliation with WrkPlan’s intuitive features. Automatically match bank transactions with...Invoicing

Simplify your invoicing process with WrkPlan Invoicing. Convent your sales order into...Order Management

Manage your sales and purchase orders in a less tiresome way. Turn...Documents

Organize and centralize your documents within a single location, and link them...Project Management

Efficiently handle all your contracted projects and reduce task times with WrkPlan....Purchase Vouchers

Seamlessly turn your purchase orders into vouchers (bills) and send them directly...Industries We Serve

Explore our integrated accounting software tailored for various sectors, including:

-

Manufacturing

-

IT Hardware

-

Foods and Beverages

-

Leather Goods

-

Rubber Goods

-

Electronics

-

Textiles

-

Retail

-

Wholesalers

-

E-Commerce

-

Paper Goods

-

Real Estate

Testimonials

Nitesh Patel

Account Manager

The WrkPlan team knows how to keep their promises. We asked them for a few customizations and they did it within just a few days. Now my teams can easily manage taxes without any issues.

Divya Teja

Project Manager

The product quality is consistently outstanding, exceeding my expectations every time I ask for development,I am completely impressed with the service and Response. The Best App .

Neha

Deputy Manager HR

Thank you to the team WrkPlan for your patience and professionalism. We have worked with them to set up a cloud-based ERP on our premises and they executed it within a stipulated time frame. WrkPlan Team is always quick to reply and provide good support!

Effortless Financial Management

Unlock seamless accounting and project tracking with WrkPlan ERP.

Sign up now and organize your financial operations from day one.

Sign Up Now !