Table of Content

Types of Accounting under VAT and Excise

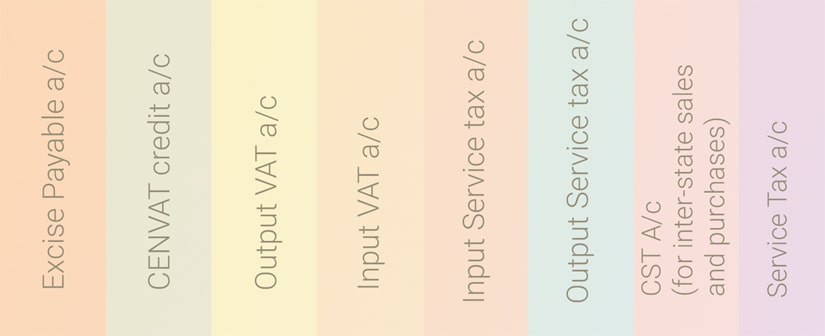

Excise, VAT, CST, and service taxes all required their own sets of accounts to be kept up to date. Additionally, the input tax credit could not be used to offset State and Central taxes. As a result, numerous ledger accounts were required. However, GST was able to eliminate the requirement for numerous ledger accounts, limiting it to a few.

The few ledgers account that businesses were required to keep under the previous administration are listed below (aside from accounts for purchases, sales, and stock):

- Excise Payable a/c (manufacturers)

- CENVAT credit a/c (manufacturers)

- Output VAT a/c

- Input VAT a/c

- Input Service tax a/c

- Output Service tax a/c

For instance, trader Mr. X was required to maintain the following minimum basic ledger accounts:

- Output VAT a/c

- Input VAT a/c

- CST A/c (for inter-state sales and purchases)

- Service Tax a/c (Since he is a trader with output VAT, he cannot claim any service tax input credits. Service tax cannot be deducted from VAT or CST)

Types of Accounting under the GST System

All these formerly indirect taxes, including excise, VAT, and service tax, are combined into one account under the GST. For each GST Identification Number (GSTIN), the same trader Mr. X should maintain the following accounts (apart from accounts like sales, purchase, and stock):

- Input CGST a/c

- Output CGST a/c

- Input SGST a/c

- Output SGST a/c

- Input IGST a/c

- Output IGST a/c

- Input Cess a/c

- Output Cess a/c

- Electronic Cash Ledger (to be kept up to date on the government’s GST portal to deposit cash for GST and make payments from it).

Impact of GST on Financials

Profit & Loss Account

| Particulars | Rs. | Particulars | Rs. |

|---|---|---|---|

| Raw material consumption | XXX[Decrease] | Sales | XXX*** |

| Purchases | XXX | ||

| Depreciation | XXX | ||

| Other Expenses | XXX |

Reduction in The Price of Raw Materials and Other Costs

GST allows for seamless input credits for purchases of goods made both within and outside of a state, resulting in a reduction in raw material costs. This is because businesses can offset input GST against the output GST owed on sales. Moreover, service-related expenses such as audit fees, engineering consultations, and legal advice that incur GST can be counterbalanced against output GST. Previously, output excise/VAT could not be subtracted from the input credit of service tax paid. As a result of these changes, businesses can look forward to cost reduction.

***The effect on sales may change based on the sector and the GST rates.

Balance Sheet

| Particulars | Rs. | Particulars | Rs. |

|---|---|---|---|

| Capital | XXX | Fixed assets | XXX[Decrease] |

| Current liabilities | XXX | Current assets | XXX |

| Tax payable | XXX | Credit receivable | XXX |

Since input credits are now available for both capital goods and services like installation and inspection that are related to such goods, the effective cost of fixed assets will decrease. There will be changes to tax payable and credit receivable as well.

Instead of maintaining the current excise payable, CENVAT credit, VAT payable, VAT credit, and service tax accounts, there will only be three accounts under each of them: SGST, CGST, and IGST.

Accounting Principles

GAAP (Generally Accepted Accounting Principles) must be used for GST. Therefore, all guidelines that come after revenue recognition, etc., will be applicable.The Retention Period for Multiple Accounts

Each taxpayer who is registered as taxable must maintain their accounting records for five years following the deadline for filing the annual return of the respective year. The taxpayer must ensure reconciliation between their accounting records and the GST returns filed throughout the financial year. Any disparities identified during the comparison process between the records and GST returns should be rectified within the accounting records or disclosed in subsequent GST returns.How Accounting Entries are made under Intra-State and Ter-State Purchases?

To explain this section, let us consider some basic business transactions as examples (all amounts are exclusive of GST).

Illustration 1: Intra-State Purchase

- Mr. X purchased goods valued at Rs. 100,000 locally on 14th April 2023.

- On 15th April 2023, he sold them for Rs. 150,000 in the same state.

- An additional legal consultation fee of Rs. 5000 was also paid by him on 18th April 2023.

- He purchased office furniture valued at Rs. 12000 on 28th April 2023.

The CGST and SGST charged 2.5% respectively, on the goods traded, 9% for legal consultation fees, and 14% for furniture.

How the entries for this scenario will look like under GST?

| Date | Particulars | Debit (Amt in Rs) | Credit (Amt in Rs) |

|---|---|---|---|

| 14/4/23 | Purchase A/c ………………Dr. | 1,00,000 | |

| Input CGST A/c ……………Dr. | 2,500 | ||

| Input SGST A/c ………….…Dr. | 2,500 | ||

| To Creditors A/c | 1,05,000 | ||

| (Being purchase of goods to be traded, bearing GST of 5% in total) | |||

| 15/4/23 | Debtors A/c ………………Dr. | 1,57,500 | |

| To Sales A/c | 1,50,000 | ||

| To Output CGST A/c | 3,750 | ||

| To Output SGST A/c | 3,750 | ||

| (Being sale of the goods to customers, bearing GST of 5% in total) | |||

| 18/4/23 | Legal fees A/c ………..……Dr. | 5,000 | |

| Input CGST A/c ……………Dr. | 450 | ||

| Input SGST A/c ……………Dr. | 450 | ||

| To Bank A/c | 5,900 | ||

| (Being the payment of legal fees for consultation services obtained for consumer court cases) | |||

| 28/4/23 | Furniture A/c ………..……Dr. | 12,000 | |

| Input CGST A/c ……………Dr. | 1,680 | ||

| Input SGST A/c ……………Dr. | 1,680 | ||

| To ABC Furniture Shop A/c | 15,360 | ||

| (Being purchase of furniture for the shop from ABC Furniture Shop on credit scheme) |

- Total Input CGST=2,500+450+1,680= Rs. 4,630

- Total Input SGST=2,500+450+1,680= Rs. 4,630

- Total output CGST=7,500

- Total output SGST=7,500

Therefore, the net CGST payable is 7,500-4,630 = 2,870 and the net SGST payable is 7,500-4,630 = 2,870.

| Data | Particulars | Debit (Amt in Rs) | Credit (Amt in Rs) |

|---|---|---|---|

| 19/5/23 | Output CGST A/c ……………Dr. | 7,500 | |

| Output SGST A/c ……………Dr. | 7,500 | ||

| To Input CGST A/c | 4,630 | ||

| To Input SGST A/c | 4,630 | ||

| To Electronic Cash Ledger A/c | 5,740 | ||

| (Being the payment of GST liability by utilizing the ITC for CGST and SGST for the tax period) |

Due to input tax credit, tax liability which was Rs. 15000was reduced to only Rs. 5740. Further, GST on legal fees can be utilized to set off against the GST payable on the goods sold, which was impossible in the previous tax system. For any surplus input tax credit, it will get carried forward to the next year.

Illustration 2: Inter-State

- Mr. X purchased goods worth Rs. 150,000 from outside the state on 1st May 2023.

- He sold the goods locally for Rs. 150,000 on 4th May 2023

- He sold goods worth Rs. 100,000 outside the state on 12th May 2023

- He paid a telephone bill for the month of April 2023 of Rs. 5000 on 14th May 2023

- An air cooler of Rs. 12000 was purchased by him locally for his office on 25th May 2023.

The CGST and SGST are charged at 2.5% of goods traded, 9% on telephone bills, and 14% on air conditioners.

The entries will look like this:

| Data | Particulars | Debit (Amt in Rs) | Credit (Amt in Rs) |

|---|---|---|---|

| 1/5/23 | Purchase A/c ………………Dr. | 1,50,000 | |

| Input CGST A/c ……………Dr. | 7,500 | ||

| To Creditors A/c | 1,57,500 | ||

| (Being purchase of goods to be traded, bearing GST of 5% in total) | 1,16,000 | ||

| 4/5/23 | Debtors A/c ………………Dr. | 1,57,000 | |

| To Sales A/c | 1,50,000 | ||

| To Output CGST A/c | 3,750 | ||

| To Output SGST A/c | 3,750 | ||

| (Being sale of goods to be traded, bearing GST of 5% in total) | |||

| 12/5/23 | Debtors A/c ………………Dr. | 1,05,000 | |

| To Sales A/c. | 1,00,000 | ||

| To Output CGST A/c | 5,000 | ||

| (Being sale of goods to be traded, bearing GST of 5% in total) | |||

| 5,900 | |||

| 14/5/23 | Telephone Expenses A/c ..…Dr. | 5,000 | |

| Input CGST A/c ……………Dr. | 450 | ||

| Input SGST A/c ……………Dr. | 450 | ||

| To Bank A/c | 5900 | ||

| (Being the payment of the telephone bill for April 2023) | |||

| 25/5/23 | Office Equipment A/c.…..Dr | 12,000 | |

| Input CGST A/c ……………Dr. | 1,680 | ||

| Input SGST A/c ……………Dr. | 1,680 | ||

| To Bank A/c | 15,360 | ||

| (Being purchase of air cooler for the shop from the local store via online payment) |

- Total CGST input =450+1,680=2,130

- Total CGST output =3,750

- Total SGST input =450+1,680=2,130

- Total SGST output =3,750

- Total IGST input =7,500

- Total IGST output =5,000

| Particulars | CGST | SGST | IGST |

|---|---|---|---|

| Output liability | 3,750> | 3,750 | 5,000 |

| Less: Input tax credit | |||

| IGST | 2,500 | – | 5,000 |

| CGST | 1,250 | – | – |

| SGST | – | 2,130 | – |

| Amount payable | NIL | 1,620 | NIL |

The IGST credit will first be utilized to set off IGST and then CGST or SGST, in any order. So, from the total input IGST of Rs.7,500, firstly it will be completely set off against IGST. So, the setoff entries will be-

| 1 | Setoff against CGST output | ||

|---|---|---|---|

| Output CGST ………………Dr. | 3,750 | ||

| To Input CGST A/c | 1,250 | ||

| To Input IGST A/c | 2,500 | ||

| (Being offset of CGST liability for the tax period, using the credit of IGST and CGST) | |||

| 2 | Setoff against IGST output | ||

| Output IGST ………………Dr. | 5,000 | ||

| To Input IGST A/c | 5,000 | ||

| (Being offset of the tax credit of IGST towards the output IGST liability for the tax period) | |||

| 3 | Setoff against SGST output | ||

| Output SGST ………………Dr. | 3,750 | ||

| To Input SGST A/c | 2,130 | ||

| To Electronic cash ledger A/c | 1,620 | ||

| (Being the balance liability of SGST for the tax period after the offset of the tax credit of SGST transferred to the electronic cash ledger of SGST) | |||

| 4 | Final payment | ||

| Electronic cash ledger A/c. | 1,620 | ||

| To Bank A/c | 1,620 | ||

| (Being payment of SGST for the tax period) |

Get Your Business Organized with WrkPlan ERP Solution

Join Us Today for Streamlined Accounting, Payroll, and Inventory Solutions and Transform Your Business.