Table of Content

What is a GST Return?

A GST return is a type of legal document compressing details of your business such as income, sales, expenses, and purchase bills. Businesses or individuals having GSTIN are mandated to file GST returns. Additionally, the taxpayer’s GSTIN status must remain active for regular GST return filing. The specific GST return to be filed depends largely on the type of taxpayer registration. Common types of registered taxpayers include regular taxpayers, e-commerce operators, composition taxable persons, non-resident taxpayers, TDS deductors, Input Service Distributors (ISD), and casual taxable persons. The tax authorities of India utilize this form to estimate net tax liability.

A registered dealer must adhere to the following details when filing their GST return:

- Sales

- Purchase

- Output GST (GST on sales)

- Input tax credit (GST on purchase)

Who is required to file GST returns?

In the new GST regime, businesses with an annual turnover exceeding Rs. 5 crores (and those not participating in the QRMP scheme) are obligated to submit two monthly returns and one annual return, totaling 25 returns annually. However, for businesses with turnover up to Rs. 5 crores, the QRMP scheme offers an alternative. Under this scheme, these businesses can opt to file returns quarterly. QRMP filers are required to submit a total of 9 returns per year, comprising 4 GSTR-1 and GSTR-3B returns each, along with an annual return. It’s important to note that despite filing returns quarterly, QRMP participants must still remit taxes every month. Additionally, certain cases, like composition dealers, necessitate separate filings, with a total of 5 GSTR submissions annually – comprising 4 statement-cum-challans in CMP-08 and 1 annual return GSTR-4.

The different types of GST return

With WrkPlan, you can easily file your GSTR1, GSTR 3B, and GSTR9 and also track all your other returns and their due dates for hassle-free tax settlement.

GSTR-1

This is a monthly return that records all outbound supplies of goods and services, and shows detailed reports on sales transactions, debit and credit notes, and revised invoices. It shows the sales transactions of the business for that month only. GST-registered taxpayers must file this return within 10 days after the month’s end, with possible extensions granted by the commissioner.

GSTR-2A

This is a document populated with supplier details from GSTR-1 for verification. Recipients can accept, reject, modify, or keep pending invoices using this information. Changes are made by the recipient in GSTR-2. This document is accessible to all registered taxpayers under GST for return filing. Discrepancies can be corrected in GSTR-2 by the recipient between the 11th and 15th of the following month.

GSTR-2B

The static return, essential for recipients of goods and services, has been presented monthly since August 2020. It contains consistent ITC data spanning a significant historical period,accessible from the previous month’s GSTR-1 filing date to the current month’s filing. Released on the 12th of each month, it allows ample time for GSTR-3B filing.

GSTR-3B

The GSTR-3B form simplifies monthly supply summaries, allowing GST taxpayers to declare their liabilities. It helps ensure timely tax payments, avoiding penalties. Both suppliers and recipients must file separately to prevent delays. Even those with zero tax liability must file it. The deadline is the 20th of the next month, with an option for NIL return if no transactions occur.

GSTR-4

The GSTR-4 is a quarterly form for taxpayers enrolled in the Composition Scheme, applicable to those with a turnover of up to Rs. 1.5 crores. It requires a fixed-rate tax payment and returns filing every quarter, aiming to ease compliance for smaller taxpayers. The deadline for GSTR-4 is the 18th of the filing month, such as April 18, 2023, for the January to March 2023 quarter.

GSTR-5

This is a monthly return that all non-resident taxpayers must file. One must provide the following details to submit this return:

- Inward supplies

- Outward supplies

- If any, interest, penalties, or fees

- Tax payable or tax paid or

- Any amount payable under the law.

(*Note that this is the only return that the non-resident needs to file. Hence, there are no other returns required to be filed by any non-resident taxpayer. The GSTR-5 return needs to be filed on the 20th of every month under the GSTIN that the taxpayer is registered.)

GSTR-5A

The GST mandates that Online Information and Database Access or Retrieval Services (OIDAR) providers file a summary return of their outward taxable supplies and the corresponding tax payable. This return, known as GSTR-5A, must be filed by the 20th of every month.

GSTR-6

This is a monthly return filed by Input Service Distributors (ISD), detailing input tax credits received and distributed, along with issued documents and distribution methods. It must be filed by the 13th of each month.

GSTR-7

This is a monthly return that is filed to deduct TDS, under the GST system. It will have the details of the TDS deducted, TDS liability payable and paid, and TDS refund claimed. The due date for this return is the 10th of every month.

GSTR-8

This is a monthly return to be filed by the e-commerce operators who are responsible for collecting tax at source. It has the details of all the supplies through the e-commerce platform and the TCS collected. The GSTR-8 return is to be filed by the 10th of every month.

GSTR-9

The GSTR-9 is an annual return filed by GST-registered taxpayers. It summarizes outward and inward supplies, including details of taxes paid, for CGST, SGST, and IGST. It consolidates monthly and quarterly returns for the financial year. All GST-registered taxpayers must file GSTR-9, except those under specific categories such as the composition scheme, input service distributors, casual taxable persons, individuals paying taxes under section 51 of the CGST act, and non-resident taxable persons.

GSTR-9A

This is presently a suspended annual return that was required to be filed by the composition taxpayers. It had an accumulation of all the quarterly returns that were filed during the financial year. From the time GSTR-4 was introduced, this return was shelved.

GSTR-9C

GSTR-9C is a certified statement reconciling accounts with GSTR-9, filed by taxpayers with over Rs. 5 crores in annual revenue. It shares the same due date as GSTR-9 and is required for each GSTIN, allowing multiple filings under one PAN.

GSTR-10

This is the final return, also called the return for canceled or surrendered registrations, which must be filed within three months of the cancellation date or order.

GSTR-11

This is required for individuals with a Unique Identification Number (UIN) to claim GST refunds on purchases made in India. It provides information on received supplies and claimed refunds

The due date for filling out GST returns:

Important Due Date for GSTR:

| GST Return Form | Compliance Particulars | Filing Period | Due Dates |

|---|---|---|---|

| GSTR 1 | For taxpayers having an annual turnover of more than INR 1.5 crore | January 2024 (monthly | 11 February |

| GSTR 1 | For taxpayers having an annual turnover of up to INR 1.5 crore | Jan- Mar 2024 (Quarterly) | 13 April |

| IFF | Optional | January 2024 (monthly) | 13 February |

| GSTR 3B | For taxpayers having an annual turnover of more than INR 5 crore in the previous FY | January 2024 (monthly) | 20 February |

| GSTR 3B | For taxpayers having an annual turnover of up to INR 5 crore in the previous FY | January 2024 (opted Monthly) | 20 February |

| GSTR 4 | For annual return in the previous FY. | 2023-24 (yearly) | 30 April |

| GSTR 5 | For all the non-resident foreign taxpayers | January 2024 (monthly | 13 February |

| GSTR 5A | For all the non-resident ODIAR service providers | January 2024 (monthly) | 20 February |

| GSTR 6 | For Input Service Distributors (ISD) | January 2024 (monthly) | 13 February |

| GSTR 7 | For all TDS deductors | January 2024 (monthly) | 10 February |

| GSTR 8 | For every TCS collector | January 2024 (monthly) | 10 February |

| GSTR 9 | For taxpayers having annual returns of more than INR 2 crore in the previous FY. | January 2024 (monthly) | 31 December |

| GSTR 9C | For taxpayers having audit returns of more than INR 5 crore in the previous FY. | January 2024 (monthly) | 31 December |

| GST CAM 08 | For taxpayers to fill their Payment Deposits. | Jan-Mar 2024 (quarterly) | 18 April |

| GST RFD-11 | For taxpayers to make exports without IGST in the previous fiscal year | 2023-24 (Yearly) | 31 March |

Late filing of GST Returns:

Filing a return under the GST is mandatory even if there is no transaction. In such cases, the taxpayer needs to file a Nil return.

Key Points to Note:

- One cannot file a return for a month if the taxpayer did not file for the previous month/quarter.

- So, late filings will have a falling effect on the taxpayer due to imposing heavy fines and penalties.

- The penalties and fines of the GSTR-1 are shown on the liability ledger of GSTR-3B which needs to be filed immediately after delay.

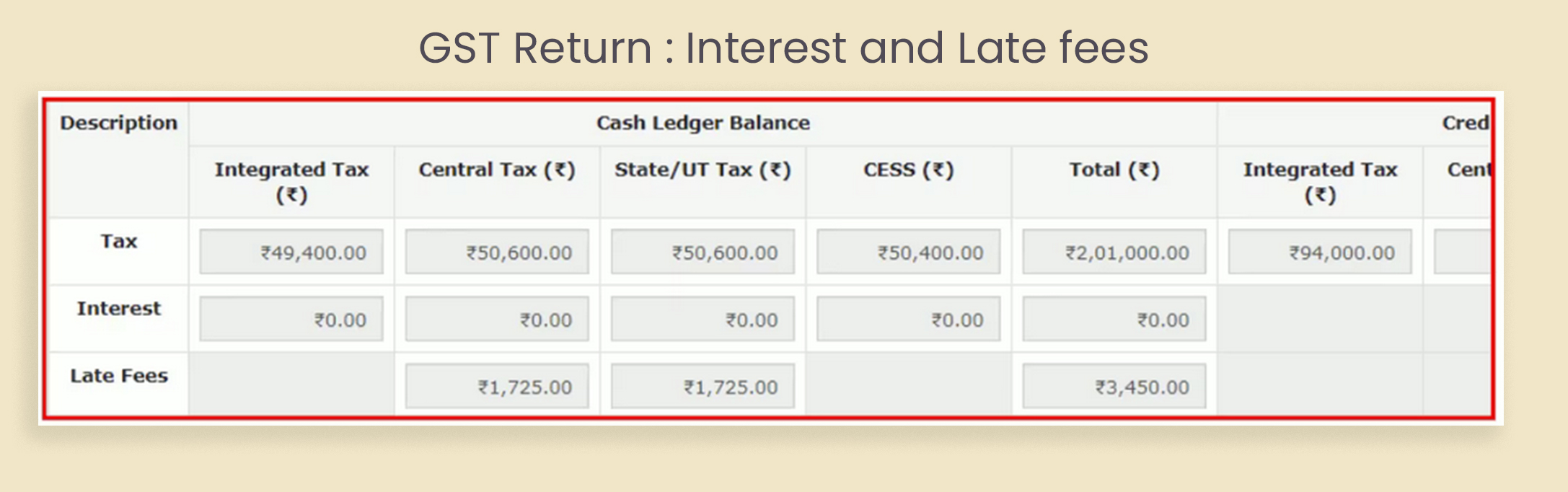

Interest and Late fees are to be paid:

- The interest levied is 18% per annum. This interest is calculated on the outstanding tax amount that is there to be paid. It needs to be calculated on the net tax liability that is mentioned in the ledger during the time of payment. The period is from the next day of the due date till the actual date of payment.

- According to the CGST Act, the late fee fine is Rs. 100 per day per act. So, the scenario is Rs. 100 under CGST, and Rs. 100 under SGST, which summed up to Rs. 200 per day. But it should be noted that the maximum fee levied is Rs. 5000 per Act. There are no late fines for the IGST Act. For the return of GSTR-9/9C, the maximum late fee to be applied is 0.25% of the turnover in the state or Union Territory.

- The late fee amount can also be reduced based on the relief schemes introduced by the government.

How to file GST returns?

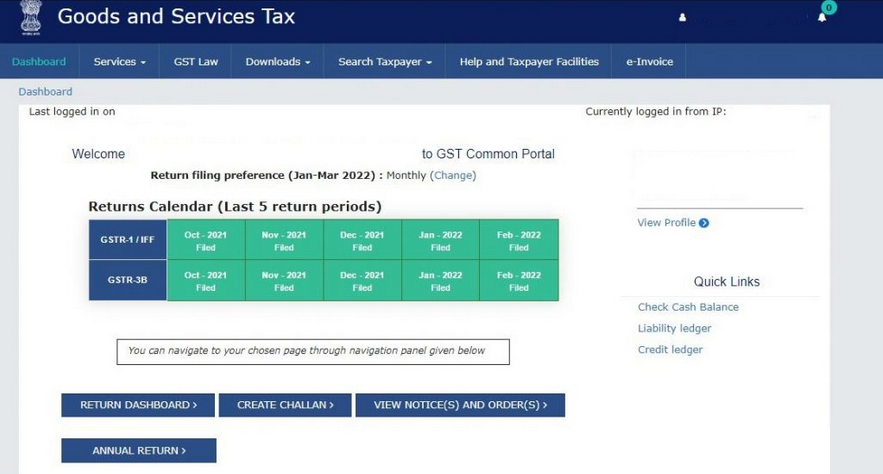

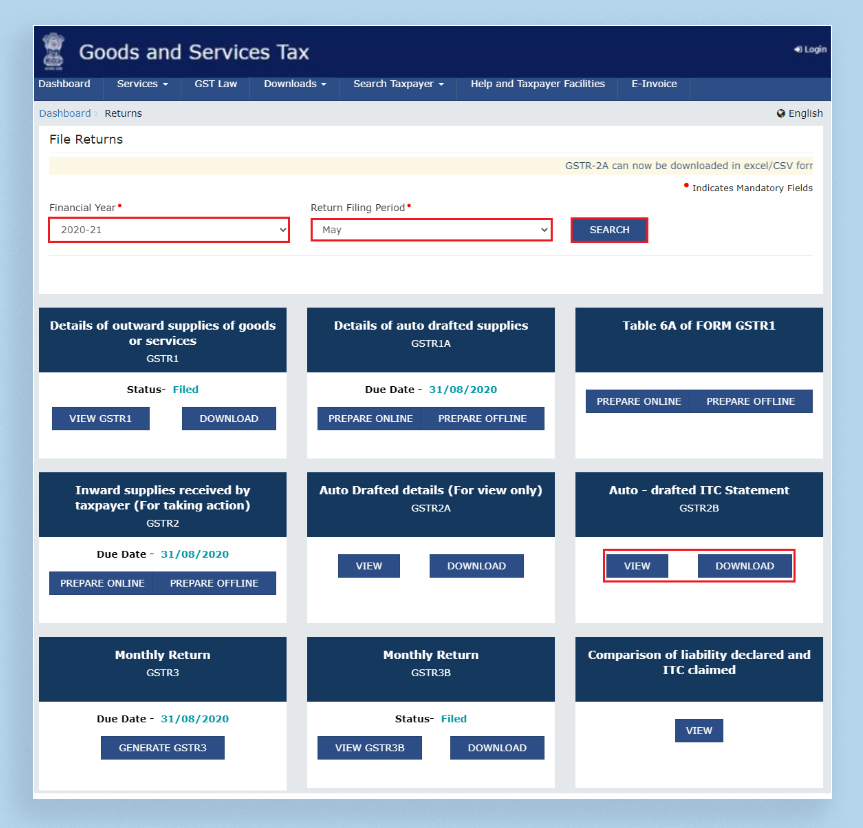

Each GST return form has its prescribed format for filing. Businesses or individuals with GSTIN need to file GST return forms from the government’s GST portal. To file your GST return, you need to log in to your registered account on www.gst.gov.in and then you can file your GST return. Once you’ve filed your GST returns you can manage all your returns in our GST billing software. You can also view all your taxes and manage them easily in WrkPlan GST software.

Get Your Business Organized with WrkPlan ERP Solution

Join Us Today for Streamlined Accounting, Payroll, and Inventory Solutions and Transform Your Business.