Table of Content

What do you mean by GST?

The Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services nationwide. Its notion was first suggested by the Kelkar Task Force in 2000 to replace the existing complex tax system. The primary objective was to establish a straightforward and unified tax structure that could replace the existing complex tax system, aiming to simplify compliance, encourage economic integration, and alleviate tax cascading. The GST bill was presented in the Indian Parliament in 2011 but faced challenges and was reintroduced in 2014. It finally received approval from both the Rajya Sabha and the Lok Sabha in 2016 and was implemented on July 1, 2017.

- GST has taken over several indirect taxes in India, including VAT, excise duty, and many service taxes.

- The GST is applied to the supply of goods and services.

- GST covers both the trade and manufacturing of commodities and the provision of services.

- GST does not apply to alcohol, motor spirit, aviation turbine fuel, crude petroleum, diesel, and natural gas, which are still subject to VAT, excise duty, and CST.

- GST is a value-added tax levied on multi-stage. It unifies India’s domestic indirect tax.

- Over 160 developed countries have adopted this taxation system.

- The GST Council monitors GST tax rates, exemptions, and administrative procedures.

- The Indian GST system categorizes goods and services into four tax slabs: 5%, 12%, 18%, and 28.

Application of GST in India

Manufacturer – For the manufacturer, the GST will be applicable on the purchase of the raw materials and on the value that was added for the development of the product.

Service Provider – Here the service provider pays the GST on the purchase price and the value added to it. But, here, the manufacturer’s GST may be discounted from the GST amount that is to be paid.

Retailer – The retailer pays the GST on the product purchased from the distributor and on the added margin. Similarly, here the additional GST will be deducted from the total GST amount that should be paid.

Consumer – The consumer pays the GST on the product that has been purchased.

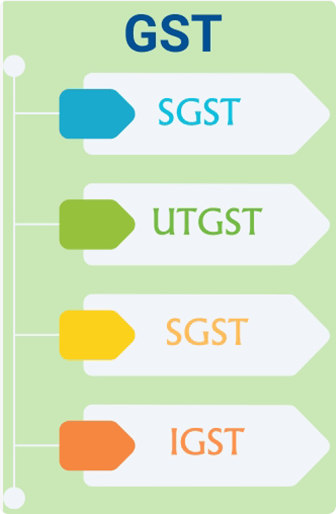

What are the various types of GST?

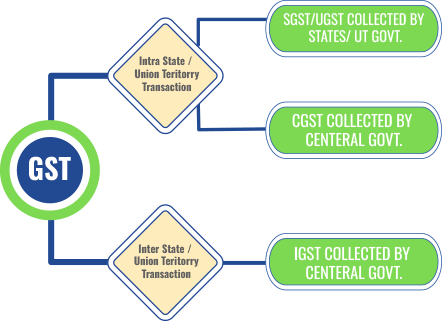

GST consists of three main components – CGST, SGST, and IGST.

- CGST- The central government levies the Central Goods and Services Tax, or CGST on interstate goods and services transactions.

- SGST- The State Government collects the State Goods and Services Tax, or SGST on interstate goods and service transactions. SGST may also comprise previously levied taxes such as VAT, Octroi, purchase tax, luxury tax, etc.

- IGST – Interstate supplies of goods and services (both imports and exports) are subject to the IGST or Integrated Goods and Services Tax. The revenue collected from this tax is distributed between the state and central governments.

- UTGST- The transactions of goods and services within Union Territories in India fall under the Union Territory Goods and Services Tax or UTGST instead of SGST. The territories include the Andaman and Nicobar Islands, Lakshadweep, Chandigarh, Dadra, Daman Diu, and Nagar Haveli.

Tax Structure Before GST

The Indian tax structure before GST was pre-dominated by VAT (Value Added Tax). India’s previous taxation system included customs duty, central excise duty, central sales tax, surcharge, and cesses. State taxes encompassed state VAT, WCT, entertainment tax, luxury tax, taxes on gambling, betting, and lottery, and sales tax deducted at source, along with surcharge and cesses. The VAT system was based on the location of goods manufacturing, sales, or services rendered. VAT had different tax rates and different laws for each state. For example, in many states excise duty was applied over VAT by the Central Government, resulting in a tax-on-tax effect, also known as the cascading effect of taxes.

Let’s take a look at the old Tax structure of India:

- Purchase of Raw Materials—(VAT)—Manufacturing

- Manufacturing— (VAT + Excise Duty)—Sold to Wholesaler or Warehousing

- Sold to Wholesaler or Warehousing—(VAT)—Sold to Retailer

- Sold to Retailer—(VAT)—Sold to Consumer

Here is the list of indirect taxes that existed before GST:

- Central Excise Duty

- Duties of Excise

- Additional Duties of Excise

- Additional Duties of Customs

- Special Additional Duty of Customs

- Cess

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entertainment Tax

- Entry Tax

- Taxes on advertisements

- Taxes on lotteries, betting, and gambling

Calculation Of GST

Since the implementation of GST, the calculation of taxes on goods and services has become simpler. GST encompasses multiple categories with different rates, organized into four slabs: 5%, 12%, 18%, and 28%. The determination of GST rates for various goods and services now depends on the nature of their transactions, distinguishing between inter-state and intra-state transactions. Easily calculate your GST with our easy-to-use GST calculator.

Intra-State tax calculation

CGST = Applied GST Rate / 2 (for 28%, CGST will be 28/2=14%)

SGST / UTGST = Applied GST Rate / 2 (for 28%, SGST will be 28/2=14%) Thus, the equation is, CGST+SGST/UTGST= Applied GST Rate.

Inter-State GST tax calculation

IGST= Applied GST Rate

To note, where applicable, GST compensation cess needs to be added to the applied GST Rate for accurate tax calculation.

GST Calculation Formula

Let us see the GST calculation formula with a simple example:

GST Amount = (Original Cost x GST Percentage) / 100

Net Amount = Original Amount + GST Amount

For instance, if a mobile phone is sold at 12,000 rupees and the GST rate for electronic devices is 18%, then the total amount of the phone will be – 12,000 + (12,000 x 18 / 100) = 14,160.

E-Way Bill

An E-way bill is an online document, mandatory for the movement of goods. The e-Way bill portal facilitates the generation of this document. As per the regulations, transportation of goods using a vehicle worth more than Rs. 50,000 necessitates an e-Way bill. The website ewaybillgst.gov.in enables e-Way bill generation. Our E-way billing software can also assist in generating GST compliance E-way bills easily.

Who can generate E-Way Bills?

Who can generate E-Way Bills?

Registered Person – E-way bill is required for the transportation of items worth more than Rs 50,000 to or from a registered individual. Even if the products are less than Rs 50,000 in value, both the registered person and the transporter can prepare and carry an E-way bill.

Unregistered Persons – Individuals without registration must also generate an e-Way Bill. In cases where an unregistered party provides goods or services to a registered entity, the recipient must ensure that all necessary compliance measures are adhered to as if they were the supplier.

Transporter – Transporters responsible for transferring products via rail, air, road, or other modes of transport must generate an e-Way Bill if the supplier has not already done so.

Get Your Business Organized with WrkPlan ERP Solution

Join Us Today for Streamlined Accounting, Payroll, and Inventory Solutions and Transform Your Business.