Introduction

On July 1, 2017, India revolutionized its tax system by implementing the Goods and Services Tax (GST). While this change simplified tax compliance, manual GST processes often lead to inefficiencies and errors. Enter cloud-based ERP software with GST compliance, a must-have for businesses seeking accuracy, efficiency, and seamless integration.

What is GST-Compliant Accounting Software?

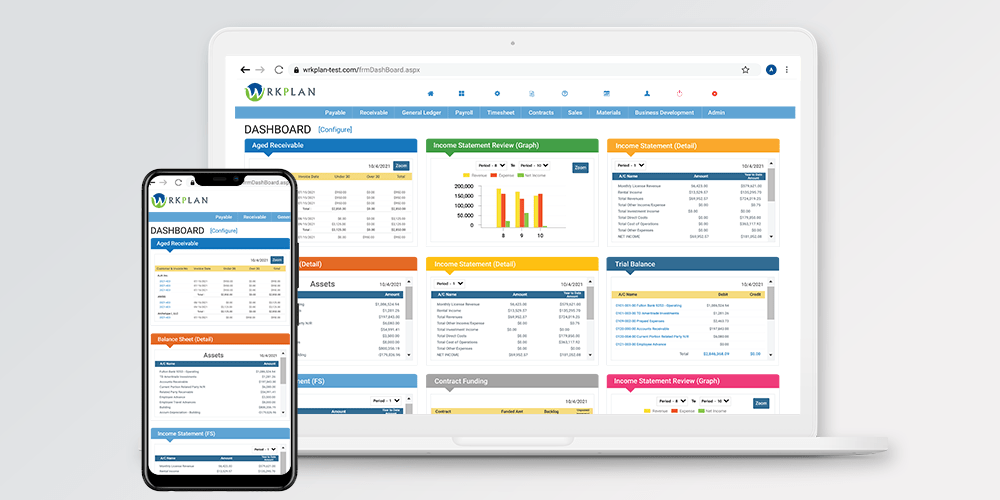

GST-compliant accounting software automates tax calculations, ensures timely compliance, and integrates smoothly with your existing systems. This advanced solution, often part of WrkPlan’s Finance & Accounting ERP, caters to businesses of all sizes, ensuring faster IT filing and error-free tax management.

Top 6 Benefits of GST-Compliant Accounting Software

-

Reconciled Accounting for GST

Automatically match sales and return data, reducing errors and saving time. Businesses leveraging ERP with GST compliance enjoy accurate reconciliations effortlessly. -

Advanced Data Security

With cloud-based accounting ERP software in India, ensure your financial data is safeguarded with robust encryption, multi-factor authentication, and automated backups. -

Customizable ERP Solutions

Modern customized ERP software supports industry-specific tax templates, streamlining GST entries for small, medium, or large businesses. -

Simplified GSTR Filing

Automate and pre-fill forms like GSTR-3B and GSTR-1 using WrkPlan’s Accounting ERP, reducing manual input and errors. -

E-Way Bills and E-Invoices

Generate GST-compliant e-way bills and e-invoices in minutes, ensuring compliance and reducing paperwork through integrated ERP with e-way bill management. -

HSN/SAC Code Integration

Simplify tax compliance with automated HSN/SAC code tracking, available in GST accounting ERP solutions for quick and accurate entries.

Conclusion

Managing GST compliance doesn’t have to be complex. With WrkPlan’s Finance & Accounting ERP, businesses can automate tax filing, improve accuracy, and stay ahead of regulatory changes.

Whether you’re looking for accounting ERP, inventory ERP, or manufacturing ERP in India, WrkPlan has the solutions you need. Explore WrkPlan’s powerful features and discover why it’s the best cloud ERP software in India. Visit our website or call 1-800-120-2449 to schedule a free demo today!